When buying or selling property in Vermont, taxes are important. One main tax is the transfer property tax. But, who pays this tax? Let’s find out.

Credit: www.peetlaw.com

Understanding Transfer Property Tax

Transfer property tax is a fee. It is charged when property changes hands. This tax helps fund state and local programs. In Vermont, both buyers and sellers have roles in this tax.

Credit: www.peetlaw.com

Buyer’s Responsibility

In Vermont, the buyer pays most of the transfer property tax. The rate is usually based on the property’s sale price. The buyer must calculate the tax. Then, they pay it at the time of closing. This is the official transfer of property.

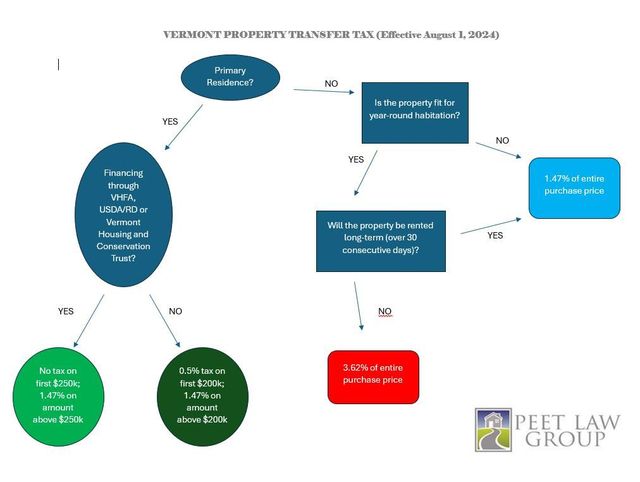

The buyer must understand the tax rate. It can change. For example, in Vermont, there is a base rate. But, if the property will not be the buyer’s main home, the rate is higher.

Buyers should check the latest tax rates. They can ask their real estate agent for help. This ensures they pay the correct amount.

Seller’s Responsibility

In Vermont, sellers have less responsibility for transfer property tax. But, they still have some duties. Sellers must provide certain documents. These documents help calculate the tax.

Sellers need to give the buyer a property transfer tax return. This form includes details about the property. It also shows the sale price. The buyer uses this form to calculate the tax.

Sellers should ensure the form is accurate. Any mistakes can cause problems. This could delay the property transfer. So, it’s important to double-check everything.

Shared Responsibilities

Both buyers and sellers must work together. This ensures the transfer tax process goes smoothly. Communication is key. Both parties need to share information openly.

Both buyers and sellers should also work with their real estate agents. Agents can provide guidance. They help ensure all steps are followed correctly.

Special Cases

There are special cases where tax rules might differ. For example, family transfers might have different rules. Inheritance can also change tax responsibilities.

In these cases, it’s best to consult a lawyer or tax expert. They can provide specific advice. This ensures all legal rules are followed.

Penalties for Mistakes

Paying the wrong tax amount can lead to penalties. These penalties can be costly. They can also delay the property transfer.

To avoid mistakes, double-check all information. Work closely with real estate agents. If unsure, seek expert advice.

Frequently Asked Questions

Who Pays Property Transfer Tax In Vermont?

The seller usually pays the property transfer tax in Vermont.

What Is The Vermont Property Transfer Tax Rate?

The tax rate is 1. 25% of the property’s sale price.

Are First-time Homebuyers Taxed Differently?

Yes, first-time homebuyers may get a reduced tax rate in Vermont.

Is There An Exemption For Transferring Property To Family?

Yes, some family transfers may be exempt from property transfer tax.

Conclusion

Transfer property tax is key when buying or selling property in Vermont. Buyers usually pay the tax. Sellers must provide accurate documents. Both parties must work together. This ensures the process is smooth and correct.

Always stay informed about tax rates and rules. This helps avoid mistakes and penalties. With careful planning, property transfer can be a smooth process.