Are you considering diving into the world of commercial real estate? The idea of owning a piece of prime property can be thrilling, but it also comes with its own set of challenges.

Navigating this complex market requires a blend of knowledge, strategy, and intuition. You might be wondering where to start, what to look for, or how to ensure a profitable investment. You’re not alone in these thoughts. Many aspiring investors share your concerns, and the good news is that you can master the art of purchasing commercial real estate.

In this guide, you’ll uncover actionable steps and insider tips that can transform your approach. Imagine the confidence you’ll feel walking into a deal with a clear plan and the insight to make smart decisions. This isn’t just about buying property; it’s about making informed choices that can lead to significant returns. So, if you’re ready to take control of your investment future and unlock the potential of commercial real estate, read on to discover how you can make it happen.

Understanding Commercial Real Estate

Types of Commercial Properties vary a lot. These include office buildings, retail spaces, and warehouses. Other types are apartment complexes, shopping malls, and industrial parks. Each type serves a different purpose. Some are used for business workspaces. Others are for selling goods or storing products. Knowing the type helps in making a good choice. It’s important to pick the right property for your needs.

Market Trends and Analysis help in making smart decisions. Real estate prices can go up or down. This depends on the location and economy. Check current trends in the market. Look at past data for better understanding. Some areas grow faster than others. This affects property value. Always stay updated with the latest market news.

Credit: www.fortunebuilders.com

Setting Investment Goals

Short-term goals focus on quick gains. They might involve buying and selling within a year. These goals often need rapid decisions. Long-term goals aim for steady growth. They can span many years. Patience is key with these goals. Both types of goals need careful planning. Understanding your goal will guide your investment choices.

Knowing your risk level is important. Some people handle high risk well. Others prefer lower risk. High risk might mean bigger rewards. But it can also mean bigger losses. Low risk usually offers small, steady returns. Decide your comfort with risk. This decision shapes your real estate plans.

Financing Options

Banks offer loans for buying property. These loans have fixed or variable rates. Fixed rates stay the same each month. Variable rates can change. Banks check your credit score. They also look at your income. Good scores and income help get better rates.

You can try other ways to get money. Crowdfunding is one option. Many people give small amounts of money. Private lenders are another choice. They can be faster than banks. Seller financing lets you pay the seller over time. Each method has different rules.

Check your money situation first. Know your savings and debts. Look at your monthly income and expenses. This helps you understand what you can afford. Keep an eye on your credit score too. A better score can lower your loan costs.

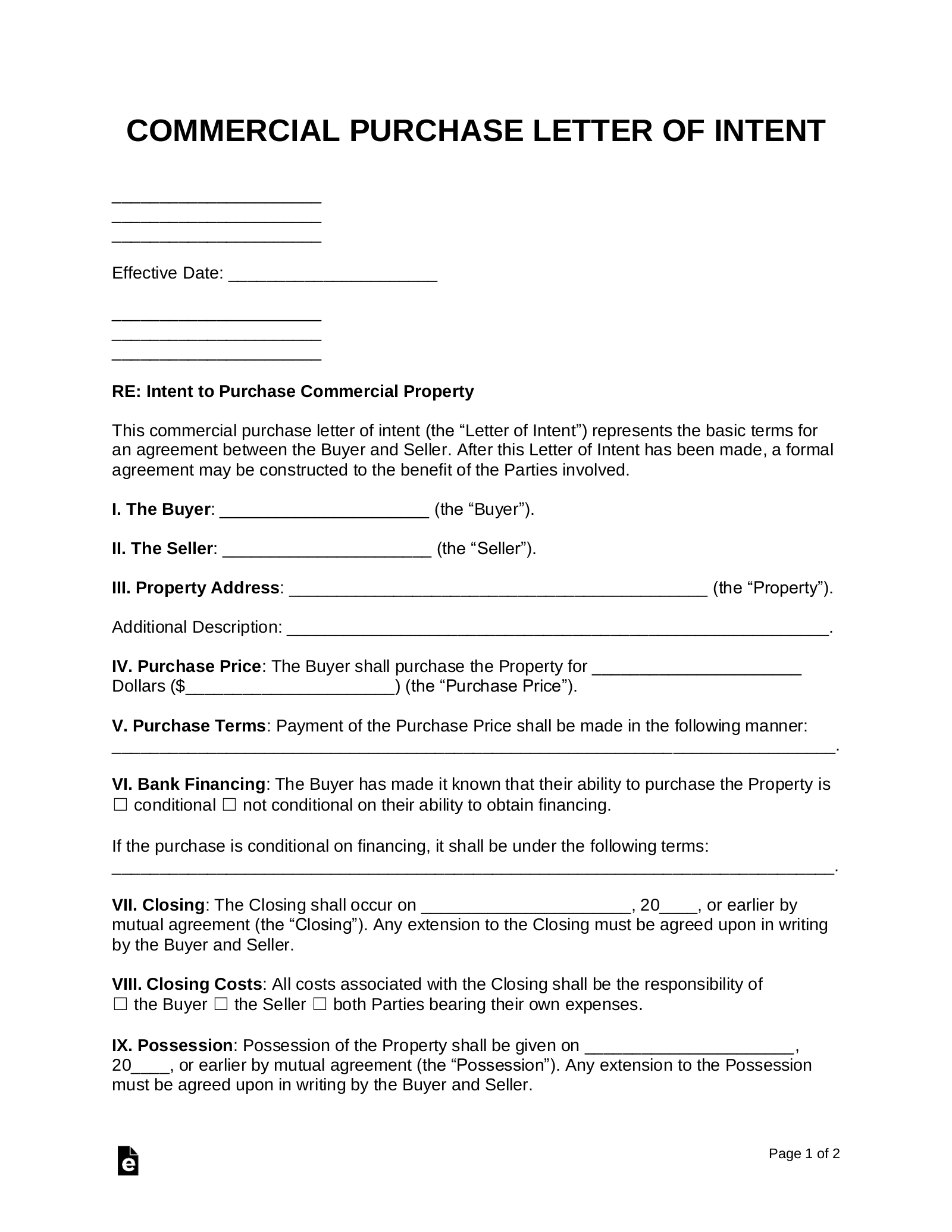

Credit: eforms.com

Finding The Right Property

Choosing the right location is key. Look for places with high foot traffic. Nearby amenities matter too. Schools, parks, and shops attract people. Think about transport links. Easy access by bus or train helps. Check crime rates and safety. Safe areas are better for business.

Property value is important. Compare prices in the area. Look for price trends over time. Check recent sales of similar properties. Understand what makes a property worth more. Size and condition matter. Renovations can increase value. Always consider the investment potential.

Real estate agents can help. They know the local market well. Agents find properties that fit your needs. They negotiate prices on your behalf. Choose an agent with good reviews. Trust is important in business. Ask questions and learn from them. They can make the process easier.

Conducting Due Diligence

Understanding legal and zoning issues is very important. Ensure the property complies with local rules. Check for any restrictions that could affect your plans. It’s crucial to know if you can build or change the property.

Conduct environmental assessments before buying. This helps find any pollution problems. You don’t want to buy a property with hidden environmental issues. These could lead to costly cleanups.

Property inspections are a must. They help find hidden problems. Inspections can reveal issues with the structure. Checking the roof, plumbing, and electrical systems is essential. This ensures the property is safe and ready for use.

Credit: legaltemplates.net

Negotiating The Deal

Making a strong offer is key. Start with a fair price. Know the market value of the property. This helps in making a smart offer. Keep your offer simple. Sellers like easy deals. Avoid complex terms that confuse. Be ready to adjust your offer. Sometimes, sellers need small changes.

Read all contract terms carefully. Make sure you understand each part. Important terms include the price, closing date, and any conditions. Ask questions if you do not understand something. It is okay to change terms you do not like. Both sides need to agree on the contract.

The closing process can be long. You need patience. Make sure all paperwork is ready. Check that payments are in order. You will sign many papers. Make sure all details are correct. This is the final step to own the property. Celebrate your new investment!

Post-purchase Management

Choose from different property management options. Hire a professional property manager. They handle day-to-day tasks. This includes rent collection and tenant communication. Another option is self-management. This can save money. But it requires more time and effort. Consider your availability and skills. Make the best choice for your property.

Set competitive rent prices. Check similar properties in the area. Offer incentives to attract tenants. This can include discounts or flexible lease terms. Keep your property well-maintained. Happy tenants stay longer. This reduces vacancy rates. Ensure all amenities are in good condition.

Schedule regular maintenance to keep the property in shape. This includes plumbing and electrical checks. Routine maintenance prevents costly repairs. Plan for upgrades over time. Modern features attract more tenants. This can increase rental income. Keep your property safe and appealing.

Frequently Asked Questions

What Is Commercial Real Estate?

Commercial real estate refers to properties used for business purposes. These include office buildings, retail spaces, warehouses, and industrial properties. Investing in commercial real estate can generate rental income and potential capital appreciation. Understanding market trends and property value is crucial for successful investment.

How To Find Commercial Properties For Sale?

Finding commercial properties for sale can be done through online listings, real estate agents, or auctions. Websites like LoopNet and Realtor. com offer extensive listings. Working with a specialized commercial real estate agent can provide valuable insights and access to off-market deals.

What Are The Financing Options For Commercial Real Estate?

Financing options for commercial real estate include traditional bank loans, SBA loans, and private lending. Each option has varying terms, interest rates, and requirements. Consulting with financial advisors and comparing lenders can help secure the best financing for your investment needs.

How To Evaluate A Commercial Property’s Value?

Evaluating a commercial property’s value involves analyzing location, market trends, and income potential. Consider factors like rental income, occupancy rates, and property condition. Conduct a comparative market analysis and consult with appraisers for accurate valuation.

Conclusion

Purchasing commercial real estate can be a smart investment. It requires careful planning and research. Understand the market trends and property values. Consult with experts to make informed decisions. Secure your financing early to avoid delays. Always inspect properties thoroughly before finalizing deals.

Negotiation skills are crucial for getting the best price. A good location can increase future returns. Stay updated with legal requirements and paperwork. Patience is key in finding the right property. Remember, every step you take brings you closer to success in commercial real estate.