Are you worried about how much the bedroom tax might affect your finances? You’re not alone.

Many people are concerned about this policy and how it impacts their everyday lives. Understanding exactly what the bedroom tax is and how it could affect your budget is crucial. This blog post will break down everything you need to know in simple terms, so you can plan ahead and make informed decisions.

Keep reading to discover how you can navigate this financial challenge with confidence and ease.

Credit: www.kentonline.co.uk

What Is Bedroom Tax?

Bedroom Tax is a charge in the UK. It affects people in council houses. It applies to those with extra bedrooms. The charge began in 2013. The government calls it “under-occupancy penalty.” People pay more rent if rooms are not used. This tax reduces housing benefit. It aims to free up bigger homes for large families. Many people do not like Bedroom Tax. Some find it unfair. Others struggle to pay the extra cost. This tax mostly impacts low-income families. It affects disabled people too. Many groups oppose this tax. They want changes to the rules.

History And Background

The bedroom tax started in the UK in 2013. It affects people living in social housing. If someone has extra bedrooms, they get less money from housing benefits. This is to make sure houses are used well. Many people were upset when this rule began. It made life harder for some families. Government wanted to save money and use houses better. Some people had to move to smaller homes. Others stayed and paid more rent. The change was big for those affected.

Purpose And Objectives

The bedroom tax aims to save money. It encourages people to use space wisely. Many people have spare rooms they do not use. This tax reduces the size of homes people can afford. It applies to those in social housing. The goal is to make housing fairer. It makes more homes available for those in need. Families with extra rooms pay more. This helps to balance the housing market. The government wants to manage housing better. It helps people with fewer resources. The focus is on making housing equal for everyone.

Credit: birminghamagainstthecuts.wordpress.com

Calculating The Bedroom Tax

Bedroom tax affects people with extra rooms. You need to count your rooms. The tax checks if you have spare rooms. Adults and children count differently. Each adult needs one room. Each pair of kids under 10 shares a room. Older kids might need separate rooms. The government has rules for this. Disabled people might need extra rooms. You must prove this need.

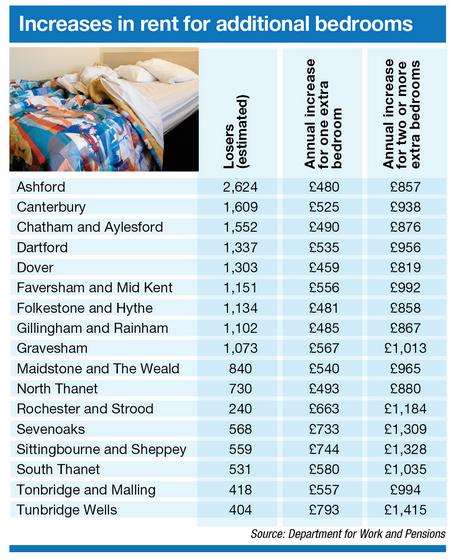

The deduction depends on your rent. 14% is for one extra room. 25% is for two or more. Your rent goes down by this percent. The more spare rooms, the higher the cut. You pay less rent because of the tax. This helps reduce extra space. The goal is fair housing for everyone.

Who Is Affected?

Eligible households for bedroom tax include those receiving certain benefits. People living in public housing might pay more. This happens if they have extra bedrooms. Families with children, single parents, and couples are often checked. The government decides who is affected.

Some people get exemptions and exceptions from bedroom tax. Elderly people are often exempt. Those with disabilities might get exceptions too. Special cases are reviewed carefully. If bedrooms are needed for medical reasons, exceptions apply. Foster carers can also be exempt.

Impact On Tenants

The bedroom tax makes life harder for many people. Families have to pay more rent. This can mean less money for food or bills. Sometimes, they need help from friends or charities. It’s tough for those with small budgets. Many families feel worried about money. This stress can affect their health. Kids may not get what they need. This tax affects many people in a big way.

The bedroom tax makes finding the right home hard. People may need to move to smaller places. But not everyone can find a new home. Some areas have few small homes. This means families must stay put and pay extra. Others might have to move far away. This can cause problems with jobs or schools. Many feel scared about losing their homes. Housing should feel safe and stable.

Impact On Housing Market

The bedroom tax changes how people pay rent. It affects many families. Some families must pay more. This is because they have extra bedrooms. People might move to smaller homes. This can make finding a home harder. More people may need smaller homes now.

Landlords may also change their plans. They might build smaller houses. This could affect the housing market. Prices for smaller homes might rise. Bigger homes may not sell as fast. The tax changes the way homes are valued. It impacts people’s choices and where they live.

Credit: www.facebook.com

Criticisms And Controversies

The bedroom tax has faced many criticisms. Some say it affects the poor. People have to pay more for extra rooms. This can be hard for families. Critics argue it can lead to homelessness. Many believe it’s unfair to disabled people. They need extra rooms for equipment. Others feel it saves the government little money. The tax can cause stress and anxiety. Some families have to move to smaller homes. This can split communities. Many people feel the tax is unfair and should change.

Government Response And Reforms

The government made changes to the bedroom tax. They listened to people’s concerns. Many people were worried about losing money. Some had to move to smaller homes. The government tried to help. They offered more support to those affected. They gave more money to local councils. This helped people who needed extra help. Some people still struggle. Changes did not help everyone. The government promised to look at the tax again. They hope to find better solutions. People hope for more help soon. This issue is important. Many families are affected. The government must act quickly. Everyone wants a fair solution.

Alternatives And Solutions

Bedroom tax can be tough for many families. Luckily, there are alternatives and solutions to manage this challenge. One option is to move to a smaller home. This might cut costs and reduce the tax burden. Another idea is to rent a room to someone. Extra rent money can help with the tax. Some families try appealing the tax decision. This might work if there is a good reason. Talking to a local housing officer can also give useful advice. They might know programs that offer help. Families can also apply for a discretionary housing payment. This helps pay the tax if money is tight. Lastly, budgeting carefully can make a big difference. Saving money on other bills might ease the pressure.

Frequently Asked Questions

What Is The Bedroom Tax?

The bedroom tax is a UK policy affecting social housing tenants. It reduces housing benefits for those with spare bedrooms. The aim is to encourage downsizing and maximize housing availability. It primarily impacts low-income families and has sparked significant debate and controversy.

How Is Bedroom Tax Calculated?

Bedroom tax is calculated based on the number of spare rooms. Housing benefits are reduced by 14% for one spare room. A 25% reduction applies for two or more spare rooms. The policy considers room usage and local housing rates.

Who Is Affected By Bedroom Tax?

Social housing tenants in the UK with spare bedrooms are affected. It primarily targets low-income families and individuals. Those with disabilities may be exempt or receive discretionary housing payments to offset the impact.

Why Was Bedroom Tax Introduced?

The bedroom tax was introduced to address housing shortages. It encourages tenants to move to appropriately sized homes. The policy aims to maximize housing availability and reduce government spending on housing benefits.

Conclusion

Understanding bedroom tax is crucial. It affects many households financially. Knowing the exact amount helps in planning budgets. This tax impacts housing benefit recipients. Simple adjustments can minimize its effects. Consider seeking advice from local authorities. They offer guidance and support.

Awareness leads to better financial management. It’s important to stay informed. Keep an eye on policy changes. These may alter tax calculations. Preparing now can ease future challenges. Explore options to manage costs effectively. Use resources wisely to lessen tax burdens.

Staying proactive makes a difference. Everyone deserves a comfortable home.